Setup a Foreign Company in Vietnam: A Comprehensive Guide for Investors

Discover how to Set up a foreign company in Vietnam: Setup a Foreign Company in Vietnam can be rewarding yet complex. As a rapidly growing economy, Vietnam offers numerous opportunities for businesses seeking to expand their operations, but navigating the regulatory landscape can be challenging. This comprehensive guide will walk you through the key considerations and steps to successfully establish your foreign company in Vietnam.

Selecting a Business Entity

When setting up a foreign company in Vietnam, the first critical decision is choosing the appropriate business entity. The most common options are:

Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a popular choice for many foreign businesses entering the Vietnamese market. LLCs are formed through capital contributions, with limited legal liability and minimum charter capital requirements, but no specific limitations on capital. LLCs can be categorized into two groups: Single-member LLCs (owned by a single individual or entity) and Multiple-member LLCs (must have two or more owners or members but cannot exceed 50 members).

Advantages of an LLC:

- Flexible organization structure, applicable to various business scopes and industries.

- The shareholder's liability is limited to the value of their shares and does not extend to personal assets.

- Enables trading with both local and international markets, maximizing potential profit.

- High transparency in operations, fast incorporation process, and flexibility in operation and management structure.

Disadvantages of an LLC:

- Restrictions on ownership transfer.

- Cannot issue shares, making it harder to raise capital.

- Registration can be complex.

- Mid to high operation costs.

Joint Stock Company (JSC)

A Joint-Stock Company (JSC) is a business entity where ownership is divided into shares, each representing a portion of the company's capital. This form of organization allows for the pooling of capital from multiple investors, who become shareholders by purchasing shares of the company. There are no specific limitations on the maximum number of shareholders, but it requires at least 3 shareholders, who can be individuals or organizations, to form a JSC.

Advantages of a JSC:

- Access to a broader capital base through the sale of shares.

- Easy ownership transfer procedures.

- Separate between ownership and management.

Disadvantages of a JSC:

- Complex legal and regulatory requirements.

- Complicated organization structure.

- Registration can be difficult and lengthy.

- High operation cost.

Branch Office

A Branch Office is a type of business establishment in Vietnam that operates as an extension of its parent company, conducting commercial activities within the country on the parent company's behalf.

Advantages of a Branch Office:

- Direct control and oversight by the parent company.

- Can remit profits abroad.

- Leverage the parent company's brand and resources.

Disadvantages of a Branch Office:

- Registration can be complex.

- Liability extends to the parent company.

- Limited to certain industry sectors.

- High operation cost.

Representative Office (RO)

A Representative Office (RO) is a type of business entity that is not allowed to engage in direct commercial activities in Vietnam. Its primary function is to conduct market research, survey, and liaison activities on behalf of the parent company.

Advantages of a Representative Office:

- Lower operational costs compared to other business entities.

- Easier registration process.

- Allows for market exploration and preparation for future investment.

Disadvantages of a Representative Office:

- Limited to non-profit activities, such as market research and liaison.

- Cannot generate revenue or engage in profit-making activities.

- Requires periodic renewal of the representative office license.

When selecting the appropriate business entity, consider your business goals, industry, capital requirements, and the level of control you desire over the operations. Consulting with local experts can help you make an informed decision that aligns with your strategic objectives.

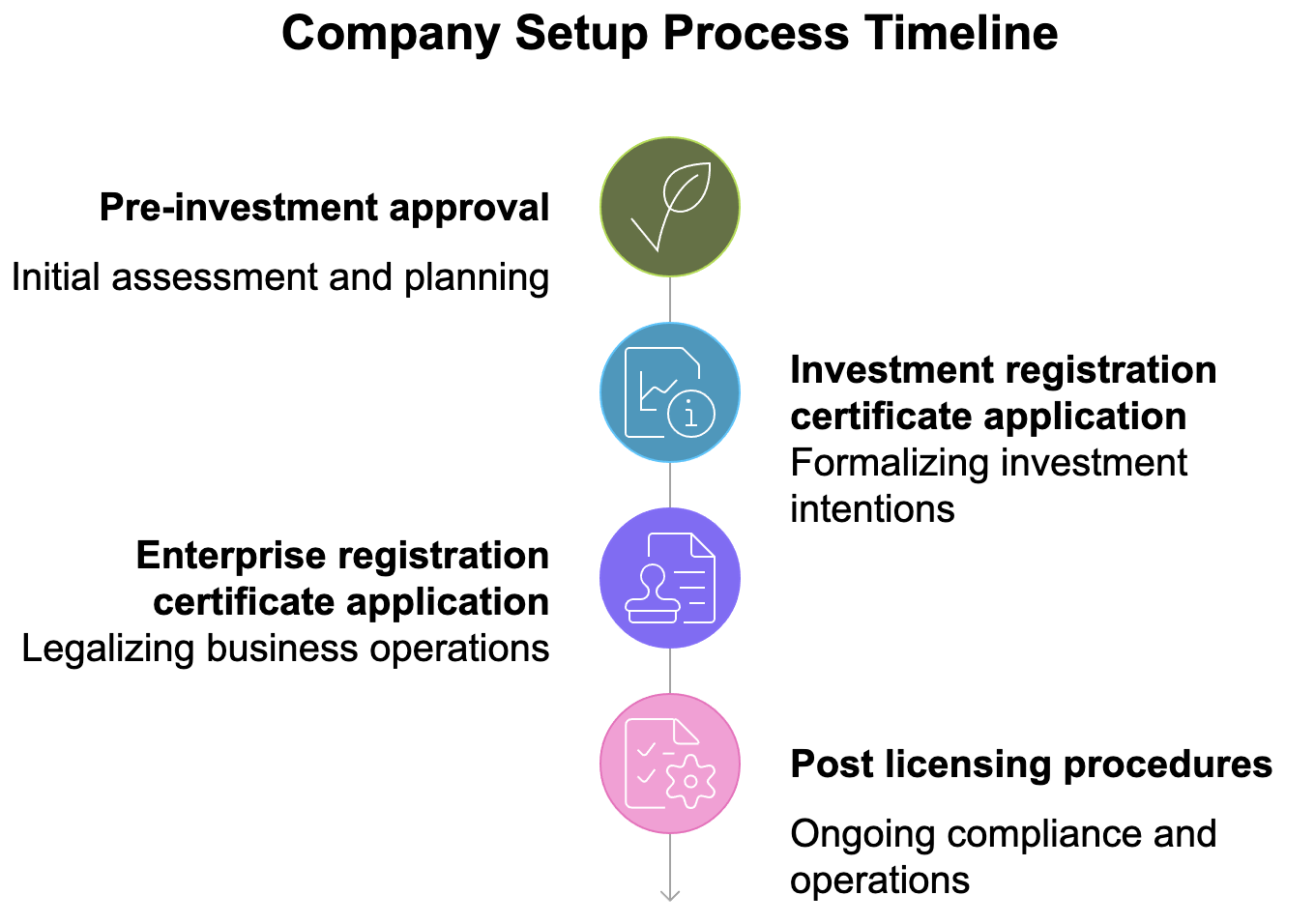

Setup Process in Vietnam for Limited Liability Company

The setup process for a Limited Liability Company (LLC) in Vietnam can be broken down into the following steps:

Step 1 – Preparation for Registration Process of LLC

Before initiating the registration process, it's essential to ensure that you have all the necessary information and documents ready. This includes:

- Determining the company's business activities and scope.

- Deciding on the company's name and registered address.

- Identifying the company's legal representative and shareholders.

- Calculating the required minimum capital for the LLC.

- Preparing the necessary documents, such as the company charter, shareholder agreements, and power of attorney (if applicable).

Step 2 – Apply for an Investment Registration Certificate

The first step in the registration process is to obtain an Investment Registration Certificate (IRC) from the local Department of Planning and Investment (DPI). The IRC serves as the approval for your company's investment project and outlines the key details, such as the business activities, ownership structure, and investment capital.

To apply for the IRC, you'll need to submit the following documents:

- Application form for investment registration.

- Company charter.

- Shareholder/member list and their capital contribution.

- Proof of legal status and identity of the shareholders/members.

- Land use rights certificate or lease agreement for the registered office.

- Financial statements or business plans.

The DPI will review the application and issue the IRC, typically within 15-45 working days.

Step 3 – Apply for Enterprise Registration Certificate

After obtaining the IRC, the next step is to apply for an Enterprise Registration Certificate (ERC) from the local Business Registration Office (BRO). The ERC is the official business registration certificate that allows the company to operate legally in Vietnam.

The required documents for the ERC application include:

- Application form for enterprise registration.

- Copy of the IRC.

- Company charter.

- Shareholder/member list and their capital contribution.

- Proof of legal status and identity of the shareholders/members.

- Land use rights certificate or lease agreement for the registered office.

- Signature specimens of the company's legal representative.

The BRO will review the application and issue the ERC, typically within 3-5 working days.

Step 4 – Apply for Other Sub-Licenses (If Required)

Depending on the company's business activities and industry, additional sub-licenses or permits may be required. These can include:

- Import/export licenses.

- Operating licenses for specific industries (e.g., manufacturing, trading, services).

- Environment permits.

- Tax registration.

The required documents and application process for these sub-licenses will vary based on the specific requirements of the relevant authorities.

Step 5 – Post-Licensing Procedures

After obtaining the necessary licenses and registrations, there are a few additional steps to complete the setup process:

- Open a corporate bank account.

- Register for tax and social insurance.

- Obtain a company seal.

- Notify relevant authorities of the company's establishment.

It's important to note that the setup process can vary depending on the specific industry, business activities, and local requirements. Consulting with local experts, such as lawyers or corporate service providers, can help ensure a smooth and efficient registration process.

Special Case – Set Up an LLC by Purchasing 100% Shares of a Vietnam Company

In some cases, foreign investors may choose to set up an LLC in Vietnam by purchasing 100% of the shares of an existing Vietnamese company. This approach can provide several advantages:

Faster Setup Process: Acquiring an existing company can significantly reduce the time and effort required to set up a new business entity, as the target company already has the necessary licenses, registrations, and infrastructure in place.

Experienced Management Team: The acquired company will have an existing management team and operational capabilities, which can help the foreign investor quickly establish a presence in the Vietnamese market.

Existing Client Base and Relationships: The acquired company's existing client base and business relationships can provide immediate access to a customer network and distribution channels.

Avoiding Minimum Capital Requirement: When setting up a new LLC, there is a minimum capital requirement that must be met. By purchasing an existing company, the foreign investor can avoid this requirement.

To set up an LLC through a 100% share acquisition, the key steps are:

- Conduct Due Diligence: Thoroughly review the target company's financial records, legal status, assets, liabilities, and any outstanding issues or obligations.

- Negotiate and Sign Share Purchase Agreement: Negotiate the terms of the share purchase agreement with the current owners, including the purchase price, payment structure, and any warranties or representations.

- Obtain Necessary Approvals: Obtain the required approvals from the relevant authorities, such as the Department of Planning and Investment (DPI) and the Business Registration Office (BRO), for the change in ownership.

- Complete Share Transfer: Execute the share transfer and update the company's registration documents to reflect the new ownership structure.

- Fulfill Post-Acquisition Obligations: Ensure compliance with any post-acquisition requirements, such as updating tax registrations, transferring licenses and permits, and notifying relevant stakeholders.

This approach can be a strategic option for foreign investors who are looking to quickly establish a presence in the Vietnamese market and leverage an existing company's resources and relationships.

Other Notable Considerations for Setting Up a Business in Vietnam (For LLC)

When setting up a Limited Liability Company (LLC) in Vietnam, there are several other important factors to consider:

Company Name

The proposed company name must be unique and not identical or similar to any existing registered company name in Vietnam. It should also comply with Vietnamese language and character requirements.

Minimum Capital Requirement

The minimum charter capital requirement for an LLC in Vietnam is VND 0 (zero Vietnamese Dong). However, the minimum capital requirement may vary depending on the specific business activities and industry.

Registered Address

The registered address of the company must be a physical location in Vietnam, such as an office, warehouse, or residential property. This address will be used for all official communications and legal purposes.

Company Representative

The company must have at least one legal representative, who is responsible for the company's operations and has the authority to act on the company's behalf. The legal representative can be a Vietnamese citizen or a foreign national with a valid visa or residence permit.

Setup a Foreign Company in Vietnam

Establishing a foreign company in Vietnam requires careful planning, attention to detail, and a thorough understanding of the local regulations and business environment. By navigating the registration process, selecting the appropriate business entity, and addressing the necessary considerations, foreign investors can lay the foundation for long-term success in the Vietnamese market.

To ensure a smooth and successful setup process, it's crucial to work closely with local experts, such as lawyers, accountants, and corporate service providers, who can provide guidance and support throughout the various stages. Additionally, staying up-to-date with the latest regulatory changes and market trends can help foreign investors adapt their strategies and capitalize on emerging opportunities.

By taking a strategic and well-informed approach to setting up a business in Vietnam, foreign companies can position themselves for growth, capitalize on the country's economic potential, and establish a strong and sustainable presence in this dynamic and rapidly evolving market.

Conclusion

Setting up a foreign company in Vietnam can be a complex and multifaceted process, but with the right guidance and preparation, it can also be highly rewarding. By understanding the available business entity options, navigating the registration procedures, and addressing the key considerations, foreign investors can lay the groundwork for a successful and profitable venture in Vietnam.

Whether you choose to establish a Limited Liability Company, a Joint-Stock Company, a Branch Office, or a Representative Office, it's essential to work closely with local experts and stay informed about the evolving regulatory landscape. By doing so, you can make informed decisions, mitigate risks, and position your company for long-term growth and success in the dynamic Vietnamese market.

☑ Why Choose LHD Law Firm

Everything we do at LHD Law Firm is focused on assisting your business through our investment law expertise and local business experience in Vietnam.

So that your enterprise can grow and expand quickly and avoid the costly traps that many start-up investors fall into at the hands of unscrupulous lawyers and agents.

? How we accomplish this?

We offer the best investment legal service in Vietnam, as well as a wide choice of INDIVIDUAL AND ECONOMIC EFFECTIVE SOLUTIONS for starting a business in Vietnam or managing an existing one.

Consulting on the establishment of foreign-owned companies in Vietnam, consulting on the establishment of Vietnamese factories and consulting on industrial production, sourcing Vietnam, supporting business registration, accounting, and tax compliance through information intelligence, low-cost operational setup, HR & admin, government liaison services, director services, country representation/management services for M&A, and much more...

→ Senior lawyer LAW FIRM

Lawyer: Thanh Thuy (email: all@lhdfirm.com)

- Lawyer specializing in advising on setting up foreign capital companies in Ho Chi Minh City

- She graduated with a master’s degree in Commercial Law - City Law University of Ho Chi Minh City.

- Consultancy language: English and Vietnamese

She is one of the top 20 lawyers in Vietnam, highly rated by Legal500 and Hg.org → specializes in foreign investment, having realized more than 6800 projects in 15 years...

Lawyer: Phuong Khanh (email: hanoi@lhdfirm.com)

A lawyer specializing in advising on setting up foreign capital companies in Hanoi

She has a master's degree in Commercial Law from Hanoi Law University.

The language of consultation is English and Vietnamese

A senior associate at LHD firm in Hanoi, she has 15 years of experience in foreign investment consulting, having implemented more than 2,466 projects in Vietnam.

YOU ONLY NEED TO PREPARE YOUR FINANCIAL AND BUSINESS STRATEGY; WE WILL SUPPORT YOU WITH A COMPLETE PLAN AND LEGAL WORK IN VIETNAM

To seek further advice or request service to Set up a company in Vietnam, Contact us by: ☑: all@lhdfirm.com

☎: Call, iMessage, SMS, WhatsApp, Viber: +84931767568