- Home

- About us

About LHD Law Firm

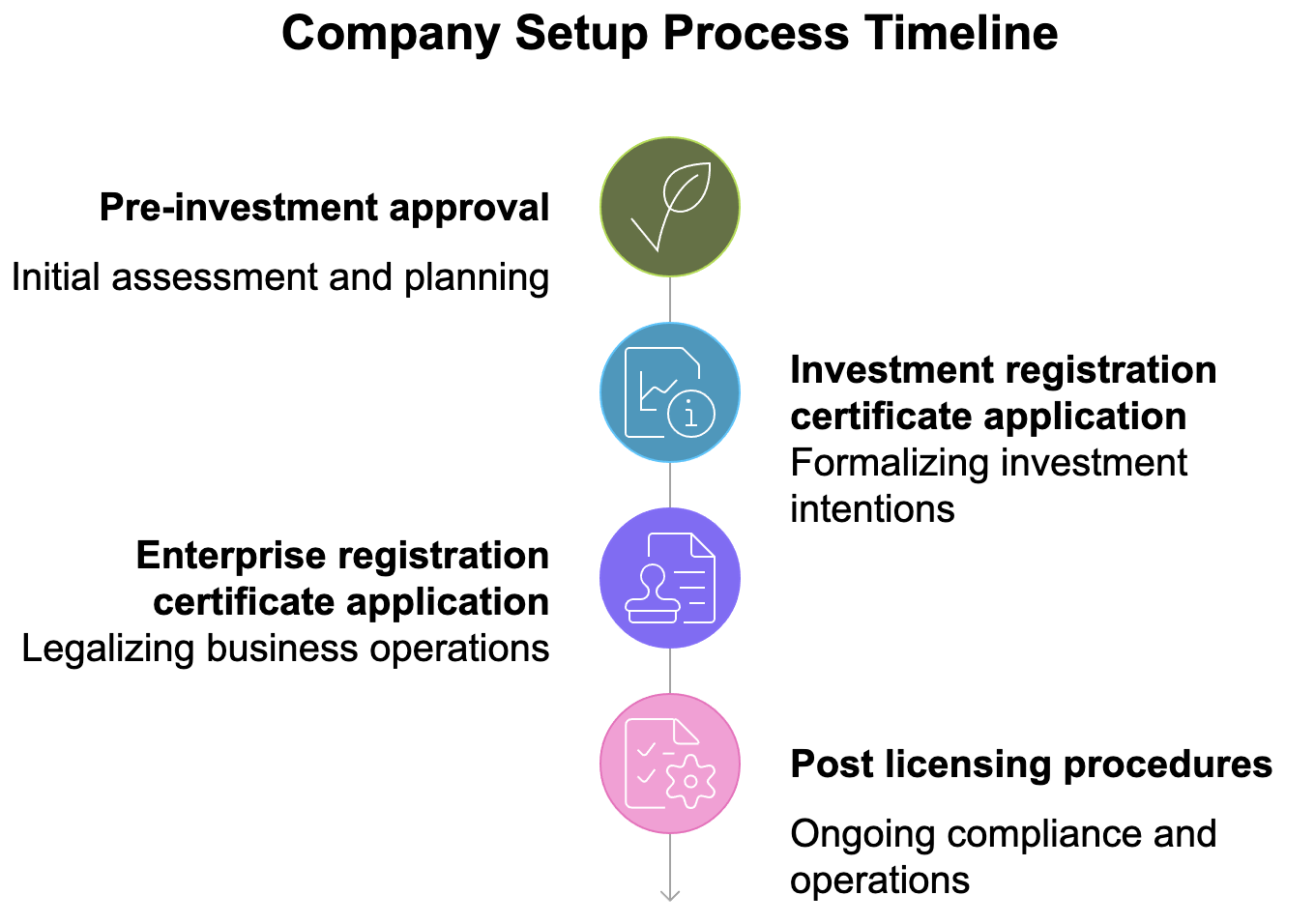

Vietnam is one of the fastest-growing economies in the world. The low cost of living and highly qualified population make it an ideal location for foreign companies who are looking to branch out and invest. However, expanding internationally has its disadvantages as well. Not knowing the local laws and regulations makes it a thousand times harder to open a company overseas.

- Locations

- Practices

- News & insights

Newsroom

Lastest news

![REGISTER COMPANY IN VIETNAM AS A FOREIGNERS [BEST ADVICE]](/data/News/tips-of-set-up-company-in-vietnam-lhd_1715582789.png)

Comment