What are required to incorporation company in Vietnam With the type of entity Wholly foreign-owned LLC (100% foreign owned company in Vietnam)?

Advise

-------------

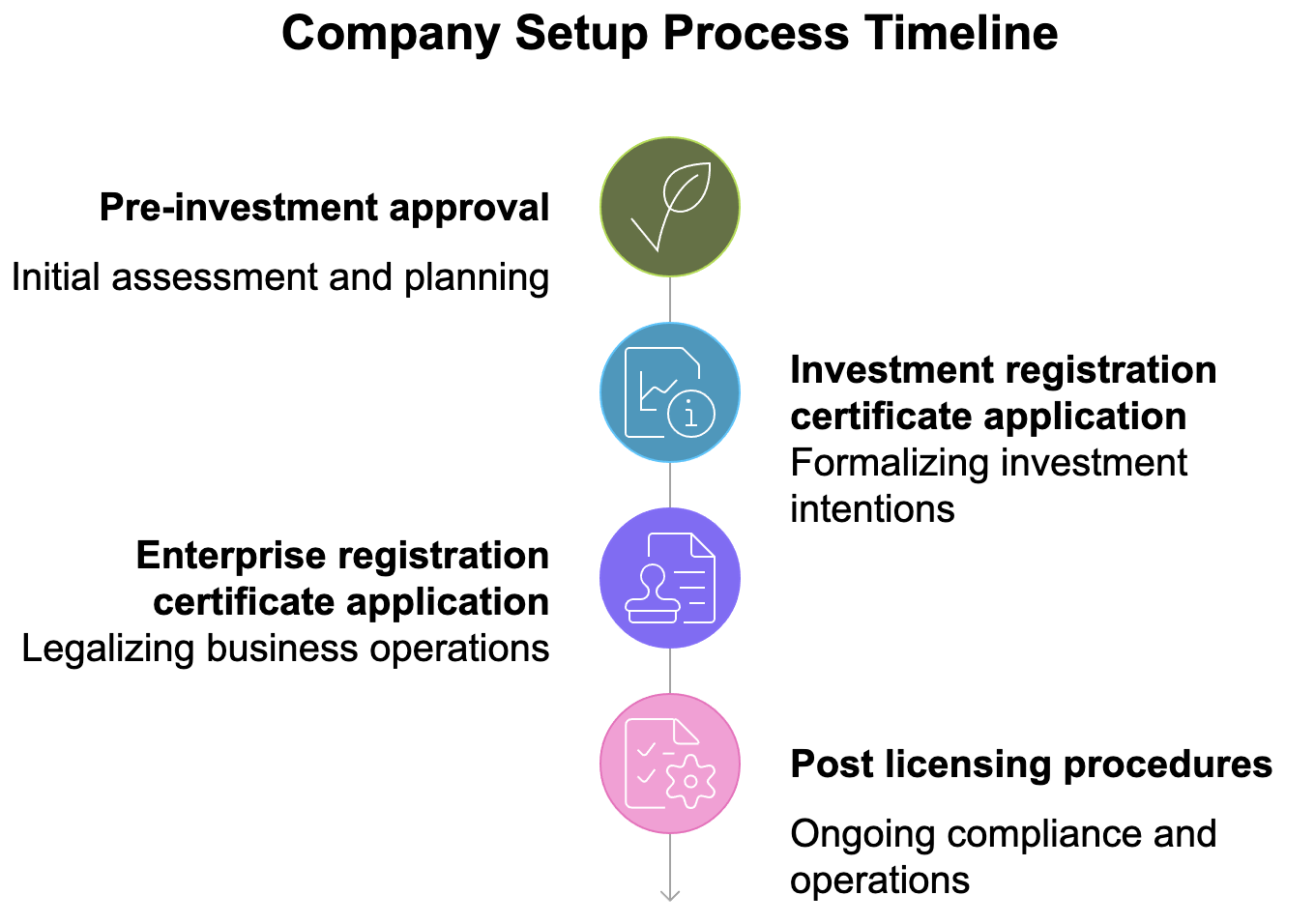

In order to complete incorporation, foreign-owned LLCs will be required to open a capital account with a local bank, required for share capital injection and transfers of future earnings abroad and obtain approval for a foreign investment certificate (FIC), required by the Vietnam government to allow foreigners to invest in Vietnam. Approval of the FIC requires a minimum investment, commonly set at US$10,000 but which may be higher in some industries.

All Vietnamese LLCs are also required at incorporation to provide the authorities with a registered address in Vietnam, which may be provided by One IBC if needed and a bank certificate of deposit for the amount of share capital, which will need to be transferred no later than 12 months after incorporation is complete.

Post incorporation, all foreign-owned LLCs must provide the authorities with an annual return and submit annual audited financial statements, which are a prerequisite for any remittance of earnings to their parent company.

Comment