- You want to ensure you prepare thoroughly before starting a business in Vietnam, but realize that things will almost certainly go awry. To run a successful business, you must adapt to changing situations.

- Conducting in-depth market research on your field and the demographics of your potential clientele is an important part of crafting a business plan. This involves running surveys, holding focus groups, and researching SEO and public data.

- Before you start selling your product or service, you need to build up your brand and get a following of people who are ready to jump when you open your doors for business.

- This article is for entrepreneurs who want to learn the basic steps of starting a new business in Vietnam.

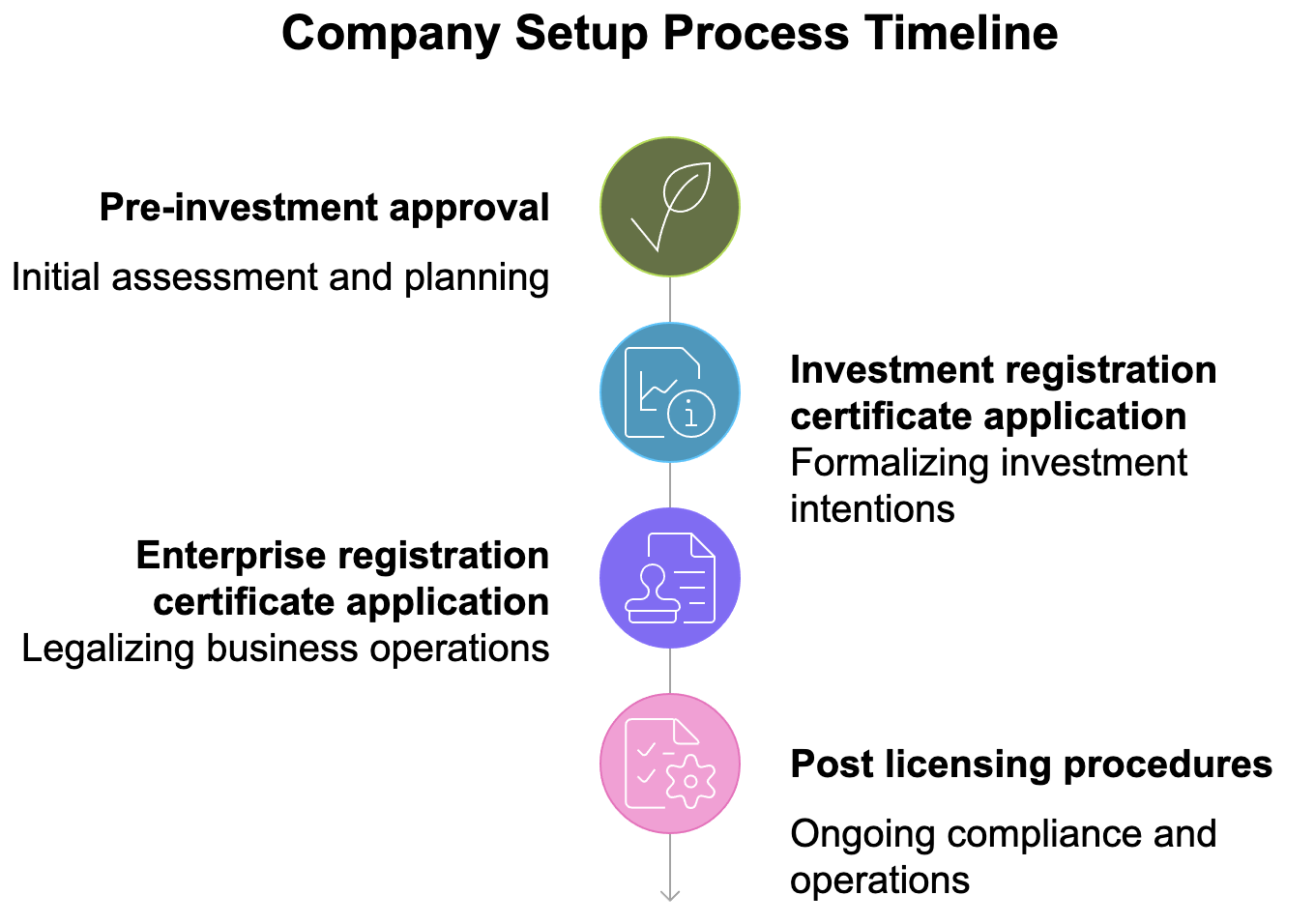

Tasks like naming the business and creating a logo are obvious, but what about the less-heralded, equally important steps? Whether it’s determining your business structure or crafting a detailed marketing strategy, the workload can quickly pile up. Rather than spinning your wheels and guessing at where to start, follow this 10-step checklist to transform your business from a lightbulb above your head to a real entity.

Comment