- Services

PRACTICES

- Debt Collection Services

- Due Deligence Investigations

- Mergers And Acquisitions

- Nominee Shareholder Vietnam

- Starting A Business In Vietnam

- Vietnam Company Registration

- Vietnam Law Firm

- Company Formation

- Setting Up Company In Vietnam

- Tax Advise

- Setting Up Presentation Office In Vietnam

- Vietnam Visa, Work Permit

- Intellectual Property

- Vietnam Litigation

TAX CONSULTING

- Locations

- Company

About LHD Law Firm

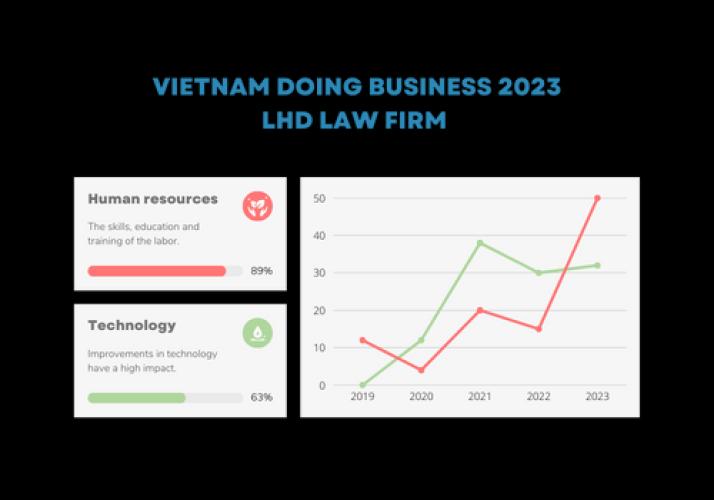

Vietnam is one of the fastest-growing economies in the world. The low cost of living and highly qualified population make it an ideal location for foreign companies who are looking to branch out and invest. However, expanding internationally has its disadvantages as well. Not knowing the local laws and regulations makes it a thousand times harder to open a company overseas.

- News & insights

Newsroom

- Business In Viet Nam

- Company Formation Vietnam

- Foreign Invest In Vietnam

- Foreign Investment In Vietnam

- How To Do Business In Vietnam

- Legal Document Update

- Real Estate Viet Nam

- Rep Office Viet Nam

- Residence Card For Foreigners

- Temple For Notification Of Cosmetic

- Visa To Vietnam

- Work Permit Vietnam

- Business License Vietnam

Lastest news

Comment