Starting a business in Vietnam can open doors to a thriving market, but the journey begins with understanding and securing the necessary business license in Vietnam. Vietnam's dynamic economy and pivotal position in Southeast Asia make it an attractive destination for entrepreneurs and investors. However, navigating the legal landscape requires a deep understanding of the country’s licensing requirements. Each step is crucial for a smooth business setup, from enterprise registration to sector-specific permits. This comprehensive guide will walk you through the essential steps and legal frameworks to ensure your business is set up for success in Vietnam.

Legal Framework for Business Licenses in Vietnam

The process of establishing a business in Vietnam is governed by a comprehensive legal framework that aims to streamline and regulate business activities. Understanding the intricacies of this framework is essential for any entrepreneur looking to secure a business license in Vietnam. The primary legislation that governs business establishment is the Law on Enterprises, complemented by the Law on Investment for foreign entities. These laws set the stage for the various types of licenses needed, each tailored to specific business activities and ownership structures.

1. The Role of the Law on Enterprises

The Law on Enterprises (Law No. 59/2020/QH14) is the cornerstone of business establishment in Vietnam. It outlines the procedures for business registration, licensing, and the rights and obligations of businesses operating within the country. This law ensures that every business, whether locally owned or foreign-invested, complies with the same set of regulations, promoting fairness and transparency in the market.

The Law on Enterprises requires all businesses to obtain an Enterprise Registration Certificate (ERC), which serves as the fundamental license for business operations. The ERC is issued by the Department of Planning and Investment (DPI) at the provincial or city level where the business is located. This certificate confirms the legal existence of the business and includes essential details such as the company's name, address, legal representative, and business lines.

In addition to the ERC, the Law on Enterprises also stipulates the need for businesses to adhere to corporate governance standards, maintain accurate records, and fulfill reporting obligations. These requirements ensure that businesses operate within the bounds of the law and maintain accountability to their stakeholders.

2. The Law on Investment and Foreign Ownership

For foreign investors, the Law on Investment (Law No. 61/2020/QH14) plays a pivotal role in navigating the business licensing process. This law delineates the conditions for foreign ownership, sectors that are restricted or prohibited for foreign investment, and various incentives available to investors. Understanding these provisions is crucial for foreign entities looking to establish a business in Vietnam.

The Law on Investment requires foreign-invested businesses to obtain an Investment Registration Certificate (IRC) before applying for the ERC. The IRC outlines the investment project's details, such as the capital structure, scope of activities, and duration of the investment. This certificate is also issued by the DPI and is a prerequisite for foreign-owned businesses.

Moreover, the Law on Investment highlights sectors that are considered conditional, meaning they require additional permits beyond the ERC and IRC. These sectors, such as banking, insurance, and telecommunications, are subject to specific regulations and oversight by relevant government bodies. Foreign investors must navigate these additional requirements carefully to ensure compliance and avoid delays in their business setup process.

3. Conditional Sectors and Special Permits

In Vietnam, certain industries are classified as conditional sectors due to their impact on public health, safety, and the economy. Businesses operating in these sectors must obtain a Business License for Conditional Sectors, which is issued by the relevant regulatory bodies. These licenses ensure that businesses meet the stringent requirements set forth by the government to operate in sensitive industries.

Examples of conditional sectors include banking, insurance, telecommunications, real estate, and education. Each of these sectors has its own set of regulations and oversight agencies. For instance, the State Bank of Vietnam oversees financial services, while the Ministry of Information and Communications regulates telecommunications. Obtaining these licenses often involves detailed assessments of the business's capabilities, including its personnel qualifications and facility standards.

Beyond conditional sector licenses, businesses may also need to secure various sub-licenses or operational permits depending on their specific activities. For example, restaurants require food safety permits, while construction businesses need construction permits. These sub-licenses are typically issued by specialized agencies and often require businesses to meet certain conditions, such as having qualified staff or appropriate facilities.

4. Navigating the Legal Framework

Navigating the legal framework for obtaining a business license in Vietnam can be complex, given the variety of licenses and permits required. Each step of the process, from obtaining the ERC to securing sector-specific licenses, must be approached with careful planning and attention to detail. Engaging with legal experts who specialize in Vietnamese business law can provide invaluable guidance and help streamline the process.

Understanding the legal framework also involves staying updated on any changes to the laws and regulations. The Vietnamese government periodically updates its legislation to reflect economic changes and policy shifts, which can impact the requirements for business licenses. Keeping abreast of these changes ensures that your business remains compliant and avoids potential legal pitfalls.

In summary, the legal framework for business licenses in Vietnam is designed to ensure that businesses operate within a regulated and transparent environment. By understanding and navigating this framework effectively, entrepreneurs and investors can lay a solid foundation for their business ventures in Vietnam.

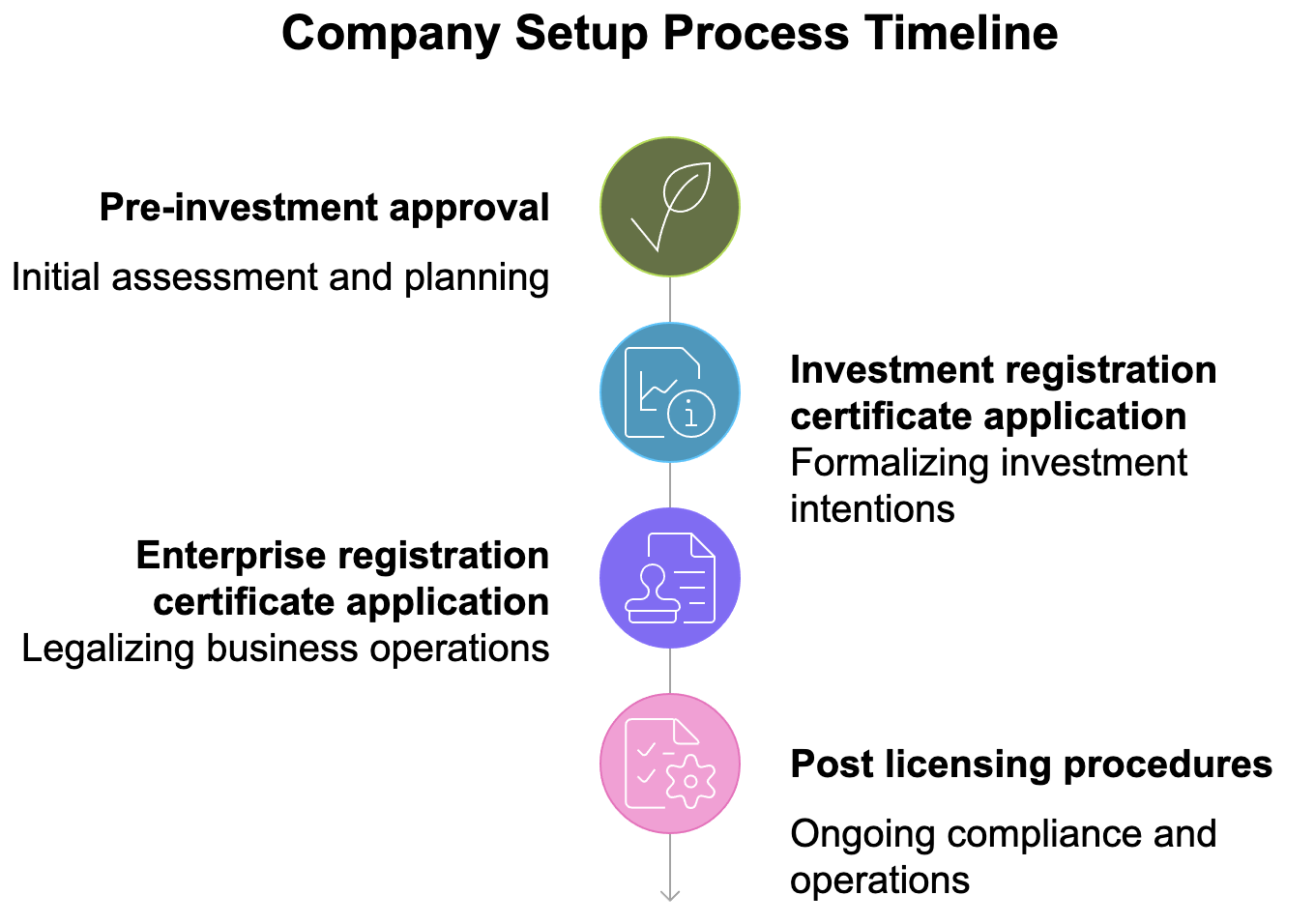

Step-by-Step Guide to Obtaining a Business License in Vietnam

Embarking on the journey to obtain a business license in Vietnam involves a series of carefully orchestrated steps. Each step is critical to ensuring that your business is legally established and ready to operate within the Vietnamese market. From choosing the right legal structure to securing necessary permits, the process requires meticulous attention to detail and a thorough understanding of the requirements. This guide will walk you through the step-by-step process to obtaining a business license in Vietnam, helping you navigate the complexities with confidence.

Step 1: Choose the Legal Structure of the Business

The first step in obtaining a business license in Vietnam is selecting the appropriate legal structure for your business. Vietnam offers several types of business entities, each with its own set of advantages and operational implications. Choosing the right structure is crucial as it affects everything from liability to taxation and governance.

Limited Liability Company (LLC)

The Limited Liability Company (LLC) is one of the most popular business structures for foreign investors in Vietnam due to its simplicity and the protection it offers. An LLC can be established as a single-member LLC, which has only one owner, or as a multi-member LLC, which can have up to 50 shareholders. The LLC structure provides limited liability protection, meaning the personal assets of the owners are protected from business debts and liabilities.

For foreign investors, the LLC structure is attractive because it is relatively straightforward to set up and manage. It also offers flexibility in terms of profit distribution and decision-making, making it suitable for a wide range of business activities. However, it's important to consider the minimum capital requirements and the need for a local legal representative when establishing an LLC in Vietnam.

Joint-Stock Company (JSC)

A Joint-Stock Company (JSC) is another option for businesses seeking to raise capital through equity investment. A JSC requires at least three shareholders and allows for the issuance of shares to the public. This structure is ideal for businesses that aim to grow through public offerings or attract significant investment from multiple sources.

The JSC structure offers the benefit of limited liability for shareholders and the potential for easier access to capital markets. However, it also comes with more stringent governance requirements, such as the need for a board of directors and annual general meetings. For businesses looking to expand and potentially list on the stock exchange, the JSC structure provides a robust framework for growth and compliance.

Branch or Representative Office

Foreign companies looking to establish a presence in Vietnam may opt for a branch or representative office. A branch office can conduct business on behalf of the parent company, including profit-generating activities, making it suitable for operational expansion. A representative office, on the other hand, is limited to non-profit generating activities such as market research and liaison with local partners.

For foreign companies, setting up a branch or representative office can be a strategic way to test the market and establish a foothold in Vietnam without the complexities of setting up a fully independent entity. However, these structures also come with their own set of regulations and requirements, such as the need for a chief representative and compliance with local laws.

Step 2: Register the Business Name

Once the legal structure of the business has been chosen, the next step is to register the business name. The business name is a critical part of your company's identity and must be unique and compliant with Vietnamese naming regulations. The Department of Planning and Investment (DPI) is responsible for approving business names, and the process involves several key considerations.

Choosing a Unique and Compliant Name

The business name must be unique and not already in use by another company in Vietnam. The DPI maintains a database of registered business names, and you can check the availability of your desired name through this database. Additionally, the name must comply with Vietnamese language and cultural norms, avoiding any offensive or inappropriate terms.

Choosing a name that reflects your business's identity and values is important for branding and marketing purposes. It's also crucial to consider the long-term implications of the name, as changing it later can be a complex and costly process. Engaging with a local legal advisor can help ensure that your chosen name meets all regulatory requirements and is strategically aligned with your business goals.

Submitting the Name Reservation Application

To reserve your chosen business name, you must submit an application to the DPI. The application typically includes the proposed name, the legal structure of the business, and contact information for the applicant. The DPI will review the application and, if approved, reserve the name for a specified period, usually 30 days.

During this reservation period, you must complete the subsequent steps of the business registration process. If the name reservation expires without completing the registration, you will need to reapply for the name reservation. This step is crucial for securing your business identity and ensuring that you can proceed with the rest of the registration process smoothly.

Step 3: Prepare the Application Dossier

Preparing the application dossier is a crucial step in the process of obtaining a business license in Vietnam. The dossier must include all the necessary documents and information required by the DPI to process your application. The contents of the dossier can vary depending on the legal structure of your business and whether you are a foreign or local investor.

Required Documents for the Application Dossier

The application dossier typically includes the following documents:

- Application Form: A completed application form provided by the DPI, filled out with accurate and up-to-date information about your business.

- Company Charter: A document outlining the company's structure, governance, and operational guidelines. The charter must be drafted in accordance with Vietnamese law and signed by the company's founders or shareholders.

- List of Shareholders or Members: A list detailing the names, addresses, and ownership stakes of all shareholders or members of the company.

- Decision on Establishment: A document signed by the company's founders or shareholders, stating their decision to establish the company and appointing the legal representative.

- Legal Representative's Information: Detailed information about the company's legal representative, including their identity documents and contact information.

- Investment Registration Certificate (IRC): For foreign-invested businesses, a copy of the IRC issued by the DPI, outlining the investment project's details.

Ensuring that all documents are accurately prepared and meet the DPI's requirements is essential for a smooth application process. Engaging with a legal advisor or business consultant can help you navigate the preparation of the dossier and ensure that all necessary information is included.

Additional Documentation for Conditional Sectors

If your business operates in a conditional sector, such as banking, insurance, or telecommunications, you may need to include additional documentation in your application dossier. These documents may include:

- Sector-Specific Licenses: Copies of any sector-specific licenses or permits required for your business activities.

- Qualifications and Certifications: Documentation demonstrating the qualifications and certifications of your personnel, particularly for roles that require specific expertise.

- Facility Information: Information about the facilities and equipment used for your business activities, ensuring they meet the standards set by the relevant regulatory bodies.

Preparing these additional documents can be complex, as each sector has its own set of requirements and oversight agencies. It's important to work closely with these agencies to obtain the necessary approvals and include them in your application dossier.

Step 4: Submit the Application and Pay the Fees

Once the application dossier is prepared, the next step is to submit it to the DPI and pay the associated fees. The submission process involves several key considerations to ensure that your application is processed efficiently and without delays.

Submitting the Application Dossier

The application dossier must be submitted to the DPI office in the province or city where your business will be located. The DPI will review the dossier to ensure that all required documents are included and meet the necessary standards. If any documents are missing or incomplete, the DPI may request additional information, which can delay the processing of your application.

It's important to submit the application dossier in person or through a authorized representative, as the DPI may require signatures or other forms of verification. Keeping a copy of the submitted dossier and any correspondence with the DPI can help you track the progress of your application and address any issues that may arise.

Paying the Registration Fees

Upon submitting the application dossier, you will need to pay the registration fees. The fees vary depending on the type of business and the legal structure you have chosen. The DPI will provide you with a fee schedule, and payment can typically be made through bank transfer or in person at the DPI office.

Ensuring that the fees are paid promptly and accurately is crucial for the timely processing of your application. The DPI will issue a receipt for the payment, which you should keep as part of your records. In some cases, additional fees may be required for sector-specific licenses or permits, so it's important to budget for these costs as well.

Step 5: Receive the Enterprise Registration Certificate (ERC)

After the DPI has reviewed and approved your application, you will receive the Enterprise Registration Certificate (ERC). The ERC is the fundamental license required for all companies operating in Vietnam and marks the official establishment of your business as a legal entity.

Understanding the ERC

The ERC contains essential information about your business, including its name, address, legal representative, and business lines. This certificate serves as proof of your company's legal existence and is required for various business activities, such as opening a bank account, registering for taxes, and obtaining a company seal.

Receiving the ERC is a significant milestone in the process of obtaining a business license in Vietnam. It signifies that your business has met the necessary regulatory requirements and is ready to begin operations. The ERC should be kept in a secure location, as it is a critical document for your business's legal and operational activities.

Next Steps After Receiving the ERC

Once you have received the ERC, you can proceed with the next steps in setting up your business. These steps include registering for taxes, obtaining a company seal, and opening a bank account. Each of these steps is crucial for ensuring that your business can operate smoothly and comply with Vietnamese regulations.

Step 6: Register for Tax and Obtain a Company Seal

After receiving the ERC, the next steps involve registering for taxes and obtaining a company seal. These steps are essential for ensuring that your business is fully compliant with Vietnamese tax laws and has the necessary tools to conduct its operations.

Tax Registration

Registering for taxes is a critical step in setting up your business in Vietnam. The process involves registering with the local tax authority and obtaining a Tax Registration Certificate. This certificate is required for businesses to fulfill their tax obligations and conduct financial transactions.

The tax registration process typically involves submitting an application to the tax authority, along with copies of the ERC and other required documents. The tax authority will review the application and, if approved, issue the Tax Registration Certificate. It's important to keep this certificate in a secure location, as it is required for various tax-related activities, such as filing tax returns and paying taxes.

In addition to the Tax Registration Certificate, businesses in Vietnam must also comply with various tax laws and regulations, including corporate income tax, value-added tax (VAT), and personal income tax. Understanding these regulations and ensuring compliance is crucial for avoiding penalties and maintaining a good standing with the tax authority.

Company Seal

Obtaining a company seal is another important step in setting up your business in Vietnam. The company seal is used to authenticate official documents and contracts, and it serves as a symbol of the company's legal authority.

To obtain a company seal, you must submit an application to a licensed seal-making company, along with a copy of the ERC and other required documents. The seal-making company will review the application and, if approved, produce the company seal. The seal should be kept in a secure location, as it is a critical tool for conducting business activities.

In addition to the company seal, businesses in Vietnam may also need to obtain additional seals or stamps for specific purposes, such as financial transactions or personnel management. Understanding the requirements for these seals and ensuring that they are properly obtained and used is essential for maintaining the integrity and legality of your business operations.

Step 7: Open a Bank Account and Contribute Capital

Opening a bank account and contributing capital are crucial steps in the process of setting up your business in Vietnam. These steps enable your business to conduct financial transactions and meet its capital requirements.

Opening a Bank Account

To open a bank account for your business, you must submit an application to a licensed bank in Vietnam, along with copies of the ERC, Tax Registration Certificate, and other required documents. The bank will review the application and, if approved, open the account.

Choosing the right bank for your business is important, as it can impact your access to financial services and the efficiency of your financial operations. It's advisable to research different banks and compare their services, fees, and customer support to find the best fit for your business needs.

Contributing Capital

After opening a bank account, the next step is to contribute the required capital to your business. The amount of capital required depends on the legal structure of your business and the industry in which it operates. For example, an LLC may have different capital requirements than a JSC or a partnership.

Contributing capital involves transferring the required funds to the business's bank account and obtaining a certificate of capital contribution from the bank. This certificate serves as proof that the capital has been contributed and is required for various business activities, such as obtaining additional permits or licenses.

Ensuring that the capital contribution is made promptly and accurately is crucial for meeting the regulatory requirements and enabling your business to operate smoothly. It's important to keep accurate records of the capital contribution and any related transactions, as these records may be required for auditing or regulatory purposes.

Step 8: Apply for Any Additional Permits or Sub-Licenses

Depending on the nature of your business, you may need to apply for additional permits or sub-licenses to conduct specific activities. These permits and licenses are typically issued by specialized agencies and often require businesses to meet certain conditions, such as having qualified personnel or appropriate facilities.

Identifying Required Permits and Licenses

The first step in applying for additional permits or sub-licenses is to identify the specific requirements for your business activities. This may involve researching the relevant regulations and consulting with the appropriate regulatory bodies to determine the necessary permits and licenses.

Common examples of additional permits and licenses include food safety permits for restaurants, construction permits for construction businesses, and environmental permits for businesses with potential environmental impacts. Each of these permits and licenses has its own set of requirements and application processes, which must be carefully followed to ensure compliance.

Preparing and Submitting the Application

Once you have identified the required permits and licenses, the next step is to prepare and submit the application. The application typically includes detailed information about your business, such as its legal structure, activities, and personnel, as well as any required documentation, such as certificates of qualification or facility information.

Submitting the application to the relevant regulatory body is a critical step in the process. The regulatory body will review the application and, if approved, issue the permit or license. It's important to keep accurate records of the application and any correspondence with the regulatory body, as these records may be required for auditing or regulatory purposes.

Finding a Legal Representative in Vietnam

Finding a legal representative in Vietnam is a crucial step in setting up your business, particularly for foreign investors. The legal representative is responsible for managing the business's legal affairs and ensuring compliance with Vietnamese regulations.

Qualifications and Responsibilities

The legal representative must be a Vietnamese citizen or a foreigner with a valid work permit in Vietnam. They must also have the necessary qualifications and experience to manage the business's legal affairs effectively.

The responsibilities of the legal representative include signing official documents, representing the business in legal proceedings, and ensuring compliance with Vietnamese laws and regulations. It's important to choose a legal representative who is trustworthy, reliable, and knowledgeable about the legal landscape in Vietnam.

Engaging a Local Legal Advisor

Engaging a local legal advisor can help you find a suitable legal representative and navigate the complexities of setting up your business in Vietnam. A legal advisor can provide valuable guidance on the legal requirements and help you prepare the necessary documentation for the application process.

Working with a local legal advisor can also help you stay updated on any changes to the laws and regulations that may impact your business. This can ensure that your business remains compliant and avoids potential legal pitfalls.

☑ Co.op with LHD Law Firm

Step 1: Get Legal Advice in English - Vietnamese

Meet with an attorney. We get legal advice on the type of business best suited to your situation.

Step 2: Find office space and legal representation for your business (if there is no available LHD office)

Then find an office space so that your business not only has a place of business but also a specific office address required by the government to apply for a business license. If you are not the legal representative for your business, you need to find a trusted partner.

Step 3: Apply for a business license (IRC, ERC or BL)

Prepare all the necessary documents and make sure that you meet all the necessary requirements before applying for a business license. Expect a 15-day waiting period for a Vietnamese-owned company and a 60-day waiting period for a foreign company.

Step 4: Legal and tax advice for foreign companies after establishment

Running your Vietnamese business now can hire employees and enter into business contracts. There are several things you need to do, such as obtaining your company seal, applying for a tax identification number, opening a company bank account, and publicly announcing your incorporation. Periodic duties include employee tax, accounting report and insurance payments.

(In addition to legal advice, we also provide accounting services for companies with foreign capital for these companies)

☑ Why Choose LHD Law Firm

Everything we do at LHD Law Firm is focused on assisting your business through our investment law expertise and local business experience in Vietnam.

So that your enterprise can grow and expand quickly and avoid the costly traps that many start-up investors fall into at the hands of unscrupulous lawyers and agents.

? How we accomplish this?

We offer the best investment legal service in Vietnam, as well as a wide choice of INDIVIDUAL AND ECONOMIC EFFECTIVE SOLUTIONS for starting a business in Vietnam or managing an existing one.

Consulting on the establishment of foreign-owned companies in Vietnam, consulting on the establishment of Vietnamese factories and consulting on industrial production, sourcing Vietnam, supporting business registration, accounting, and tax compliance through information intelligence, low-cost operational setup, HR & admin, government liaison services, director services, country representation/management services for M&A, and much more...

→ Senior lawyer LAW FIRM

Lawyer: Thanh Thuy (email: all@lhdfirm.com)

- Lawyer specializing in advising on setting up foreign capital companies in Ho Chi Minh City

- She graduated with a master’s degree in Commercial Law - City Law University of Ho Chi Minh City.

- Consultancy language: English and Vietnamese

She is one of the top 20 lawyers in Vietnam, highly rated by Legal500 and Hg.org → specializes in foreign investment, having realized more than 6800 projects in 15 years...

Lawyer: Phuong Khanh (email: hanoi@lhdfirm.com)

A lawyer specializing in advising on setting up foreign capital companies in Hanoi

She has a master's degree in Commercial Law from Hanoi Law University.

The language of consultation is English and Vietnamese

A senior associate at LHD firm in Hanoi, she has 15 years of experience in foreign investment consulting, having implemented more than 2,466 projects in Vietnam.

YOU ONLY NEED TO PREPARE YOUR FINANCIAL AND BUSINESS STRATEGY; WE WILL SUPPORT YOU WITH A COMPLETE PLAN AND LEGAL WORK IN VIETNAM

To seek further advice or request service to Set up a company in Vietnam, Contact us by: ☑: all@lhdfirm.com

☎: Call, iMessage, SMS, WhatsApp, Viber: +84931767568