DOING BUSINESS IN VIETNAM GUIDE

The Vietnamese economy is projected to expand at a 6% annual rate in the years ahead, fueled by an expanding domestic market and a young, educated workforce, along with the fastest-growing middle class in South Asia. Nevertheless, investors should be aware of specific challenges when conducting business in Vietnam.

Vietnam stands as a success story in terms of development. Thanks to constant economic reforms and favourable global trends, the nation has transformed from one of the world's poorest into a middle-income economy within a single generation. Here are the primary 9 challenges associated with doing business in Vietnam.

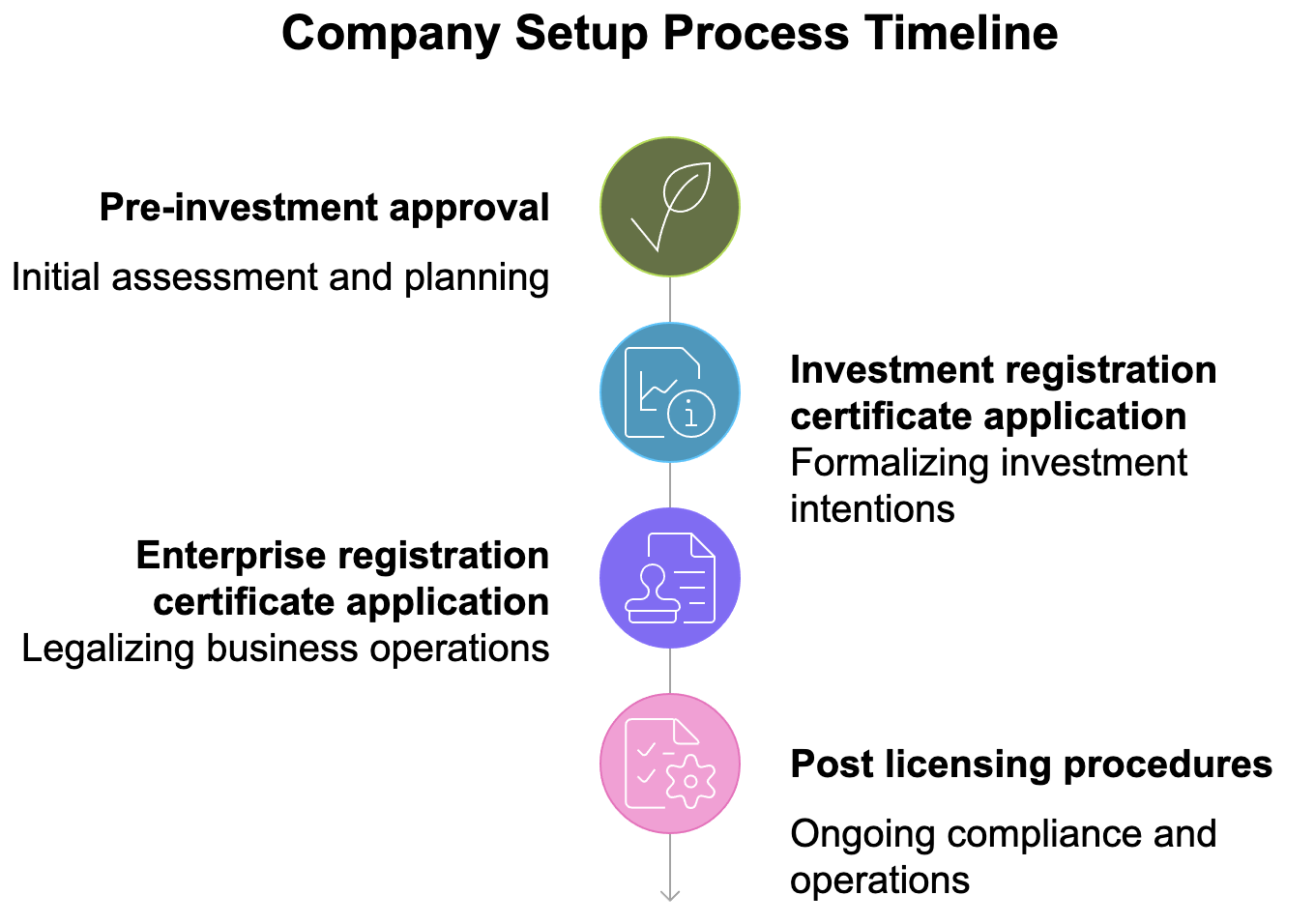

1. Starting a company

According to TMF Group’s Global Business Complexity Index (GBCI) for 2024, Vietnam is ranked 49th in terms of business environment complexity. This represents a decrease from its 46th position in 2023 and 42nd in 2022, which indicates a simplification of business procedures over the last three years.

The process of starting a business now involves two procedures instead of seven, and the time required has been shortened by 15 days to less than one month and 15 days for regular business operations. To register, you must provide a company address and a signed lease. Certain foreign investments are subject to restrictions and conditions. Foreign cash investments are prohibited in activities involving specific types of drugs, chemicals, minerals, some biological businesses, and firecrackers.

2. Reporting and filing

All documents must be written in Vietnamese, and foreign paperwork must be accompanied by certified translations. These translations should be authenticated by courts in the investor's home country and then certified at the Vietnamese embassy. Licenses are also issued in the Vietnamese language. While some licensing and reporting procedures can be completed electronically, the requirements for language and authentication remain the same. Mandatory investment statistics reports are required, and penalties will be applied for violations.

3. Currency

The Vietnamese dong is closely tied to the US dollar using a crawling peg, ensuring exchange rate stability between trading partners. As one of the most stable Asian currencies, the dong's strength has supported FDI. The government tightly regulates foreign currency transactions, with inflow regulations generally being more relaxed than outflow restrictions.

4. Taxes

In recent years, Vietnam's government has undertaken reforms to streamline the complex tax system. The Ministry of Finance has introduced regulations designed to create a more favourable environment for businesses, including the implementation of electronic invoices and simplified procedures for VAT and CIT filing. Electronic tax declarations were introduced in late 2017 to improve the IT aspect of tax reporting. Moreover, amendments to existing laws concerning CIT, VAT, and tax administration aim to resolve ambiguous tax issues and decrease the tax compliance burden for companies operating in Vietnam.

5. Payments and the banking system

While Vietnam's banking system is relatively young compared to many of its Asian counterparts, it ranks among the world's fastest-growing. The economy, formerly reliant on cash, now features a mix of banking models, including state-owned banks, joint-stock commercial banks, and banks owned either through joint ventures or exclusively by foreign shareholders. Digitalisation has lagged behind other Asian markets; however, digital banking has increased since COVID-19, when cashless payments saw a surge due to restrictions on in-person shopping. Digital banking in Vietnam, along with the developing fintech sector, is likely to continue to evolve in the near future.

6. Bureaucracy and transparency

Vietnam is transitioning and moving towards a more globalised perspective. Consequently, bureaucratic processes remain complicated, and a persistent lack of transparency exists as regulations evolve toward modern standards. As a result of overlapping jurisdictions among certain government ministries and complex commercial laws and regulatory regimes, inconsistent governmental policies can arise. Further complicating due diligence and KYC are poor corporate disclosure policies and a lack of financial transparency.

Recent improvements include control of corruption within the public service sector and the implementation of e-governance. Vietnam is progressively updating administrative procedures through the public service website system as a means of enhancing transparency. However, these updates remain at an early stage, characterised by system limitations and the unavailability of certain services.

7. Intellectual property

Although Vietnam has regulations safeguarding intellectual property rights, their enforcement is notably weak, and IP infringement continues to be a problem. As of 2023, Vietnam was ranked 6th among the top 20 countries with the highest rates of pirated software use. The government is actively addressing the issue by introducing new legislation aimed at protecting IP rights, encompassing copyright, industrial property, and plant breeding rights. Foreign companies seeking to register intellectual ownership should apply to the National Office of Intellectual Property of Vietnam (NoIP) through an authorised agent. Even with the authority of the NoIP, it is recommended that companies with IP take care of this process prior to exporting to or establishing a presence in Vietnam.

8. Corruption

Despite substantial reforms over the years, corruption remains widespread, and companies doing business in Vietnam are likely to encounter it eventually. The Vietnamese government is dedicated to combating corruption, having implemented anti-corruption laws, developed anti-corruption strategies, strengthened institutions, and ratified the UN Convention Against Corruption (UNCAC). Compared to some neighbouring countries, the anti-corruption frameworks are thorough, but their practicality is challenging to enforce. While providing bribes, making facilitation payments, and taking expensive gifts to foster business ties are all unlawful, they are often practised, posing a challenge for investors who advocate a zero-tolerance policy.

9. Respecting the business culture

Vietnamese business culture revolves around the social connections between business partners, potentially influenced by Confucianism. Dealmakers should expect to share personal details about their families and hobbies, as this can enhance relationships with local suppliers and ultimately influence business outcomes. Referrals and recommendations are key to establishing connections, and the method of introduction may affect pricing. Seniority is also crucial, particularly when dealing with government agencies or state-owned organisations. Collective decision-making is fundamental in Vietnamese business culture. Committees, rather than single individuals, make most decisions. Thus, the group dynamic takes precedence over individual connections.

⭕ Services of LHD Law Firm for doing business in Vietnam

Service of setting up a foreign-invested company

Foreign investment consulting is the professional consulting segment of LHD Firm. Over 15 years of work, we have completed legal work for more than 6,800 projects for businesses and individuals from 32 countries worldwide.

LHD Law Firm is rated in the top 10 leading law firms in Vietnam in terms of consulting on setting up foreign capital companies in Vietnam, ranked at Legal500 and Hg.org

- Advising on conditions for establishing foreign-invested companies for investors according to specific business fields or investors' nationality;

- Consulting on selecting the correct type of company for investors: Limited liability company or Joint-stock company, head office address, capital, business lines, opening a capital transfer account, capital contribution term, etc

- Guide investors to prepare the necessary documents to establish a foreign-invested company;

- Consulting and drafting company establishment documents for investors;

- Representing investors to work with competent Vietnamese state agencies in the process of establishing businesses for investors

- Apply for a foreign loan for a business to borrow from a parent company or a foreign organisation.

- Exhaustive advice on activities arising from doing business in Vietnam for investors.

With experience and a professional service attitude, LHD Law Firm is committed to satisfying foreign investors in Vietnam.

☖ Legal Advice - LHD Law Firm

► Review the documents to be prepared, including LEGAL CONSULTATIONS (LAW, POLICY, TAXES, and human resources).

► After receiving the investment certificate, receive advice on how to obtain the business registration certificate.

► Advice and application for the Enterprise Certificate (ERC) and the Investment Certificate (IRC), in addition to the Business License issued by the Ministry of Industry and Trade (Business License)

► Consultation and production of a seal engraving and report using seal samples

► Regular legal advice after the opening of the business

► Legal advice about taxes, work permit, temporary residence card and child permit (if applicable)

► Support for the registration of trademarks, designs and inventions when required by businesses (LHD Law Firm is a representative of IP No. 146, the National Office of Intellectual Property, NOIP)

►Advice on CIT, PIT, and monthly, quarterly and annual tax returns

►Social insurance consultation, salary calculation (payroll)

►Consulting for personnel selection in Vietnam

►Trademark, Design, and Invention Protection Consulting

►Consultation on labour law, taxation, and contracts in Vietnam

► Virtual office rental for companies with foreign capital to provide invoice redemption.

☑ Co-op with us

Step 1: Get Legal Advice in English - Vietnamese

Meet with an attorney. We get legal advice on the type of business best suited to your situation.

Step 2: Find office space and legal representation for your business (if there is no available LHD office)

Then find an office space so that your business not only has a place of business but also a specific office address required by the government to apply for a business license. If you are not the legal representative for your business, you need to find a trusted partner.

Step 3: Apply for a business license (IRC, ERC or BL)

Prepare all the necessary documents and make sure that you meet all the requirements before applying for a business license. Expect a 15-day waiting period for a Vietnamese-owned company and a 60-day waiting period for a foreign company.

Step 4: Legal and tax advice for foreign companies after establishment

Running your Vietnamese business now can hire employees and enter into business contracts. There are several things you need to do, such as obtaining your company seal, applying for a tax identification number, opening a company bank account, and publicly announcing your incorporation. Periodic duties include employee tax, accounting report and insurance payments.

(In addition to legal advice, we also provide accounting services for companies with foreign capital for these companies)

☑ Why Choose LHD Law Firm

Everything we do at LHD Law Firm is focused on assisting your business through our investment law expertise and local business experience in Vietnam.

So that your enterprise can grow and expand quickly and avoid the costly traps that many start-up investors fall into at the hands of unscrupulous lawyers and agents.

How do we accomplish this?

We offer the best investment legal service in Vietnam, as well as a wide choice of INDIVIDUAL AND ECONOMIC EFFECTIVE SOLUTIONS for starting a business in Vietnam or managing an existing one.

Consulting on the establishment of foreign-owned companies in Vietnam, consulting on the establishment of Vietnamese factories and consulting on industrial production, sourcing Vietnam, supporting business registration, accounting, and tax compliance through information intelligence, low-cost operational setup, HR & admin, government liaison services, director services, country representation/management services for M&A, and much more...

YOU ONLY NEED TO PREPARE YOUR FINANCIAL AND BUSINESS STRATEGY; WE WILL SUPPORT YOU WITH A COMPLETE PLAN AND LEGAL WORK IN VIETNAM

To seek further advice or request service to set up a company in Vietnam, contact us at: ☑: all@lhdfirm.com

→ Senior lawyer

Lawyer: Thanh Thuy (email: all@lhdfirm.com)

Lawyer specialising in advising on setting up foreign capital companies in Ho Chi Minh City

- She graduated with a master’s degree in commercial law from City Law University of Ho Chi Minh City.

- Consultancy language: English and Vietnamese

- She is one of the top 20 lawyers in Vietnam, highly rated by Legal500 and Hg.org → specialises in foreign investment, having realised more than 6800 projects in 15 years..