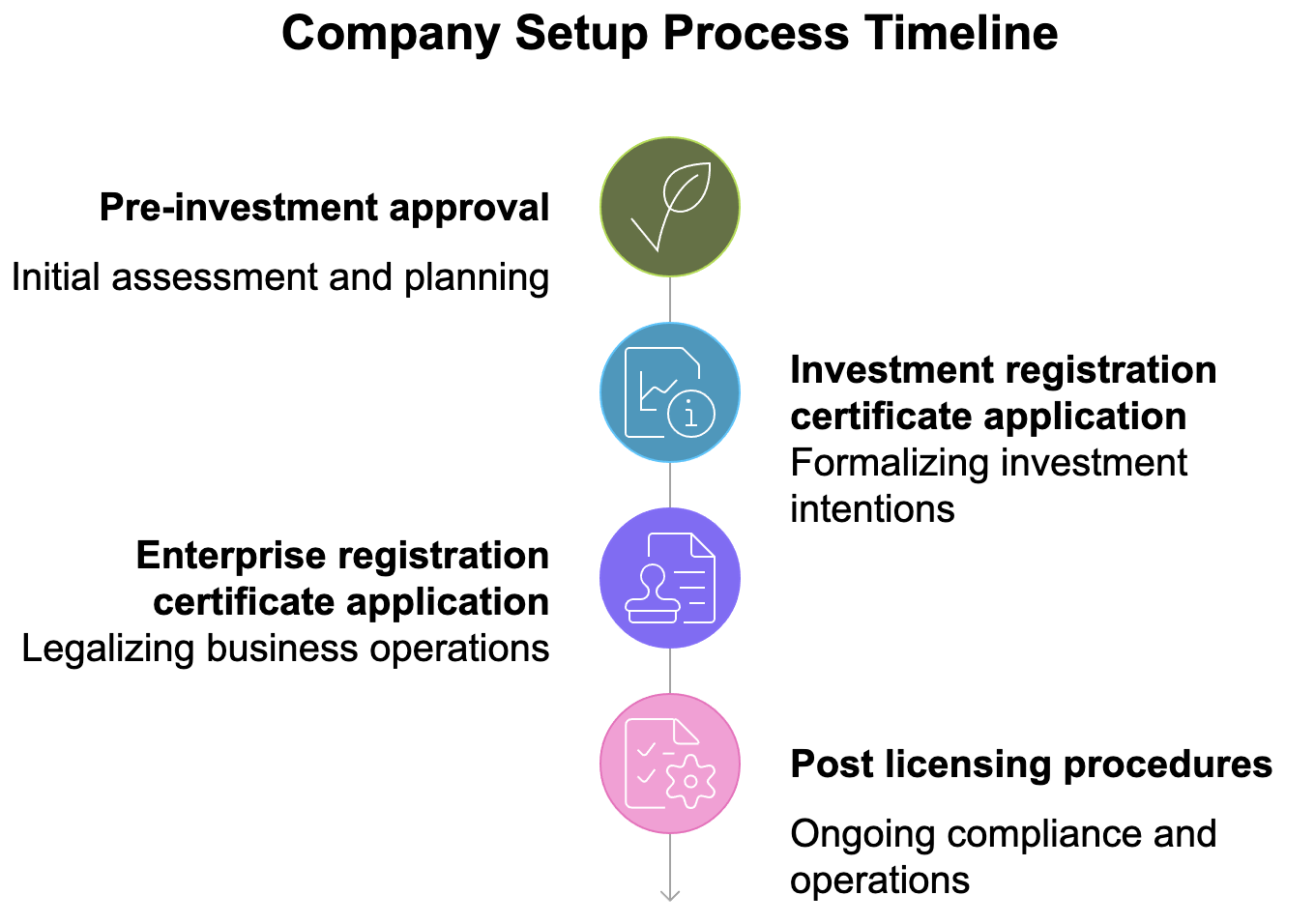

1. FDI Company Setup & Licensing

Incorporation of 100% foreign-owned entities, joint ventures, or representative offices with Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC)

LHD Law Firm can provide clients with legal advisory opinions most helpful in all areas of investment, established companies with foreign investment capital in Vietnam:

- Apply for an investment license (certificate) for investors who are individuals, organisations and foreign companies in Vietnam;

- Apply for an investment license (certificate) associated with the establishment of projects, enterprises and foreign affiliates for individual investors, institutions, and foreign companies in Vietnam;

- Registration of business lines, operation contents for investment projects, enterprises, branches associated with investment projects for private investors, institutions, foreign companies in Vietnam;

- Registration of application for import and export, distribution, wholesale, retail;

- Registration for the examination of investment projects.

Procedures for setting up businesses abroad invested in Vietnam, including the steps taken to establish the following:

Foreign-owned company registration in Vietnam

Starting a business in Vietnam has become increasingly attractive due to the country’s rapid economic growth and favorable investment climate. However, entrepreneurs must navigate a complex registration process that can be daunting without proper guidance.

The registration involves several critical steps:

- Choosing a Business Structure: Entrepreneurs must decide on the type of entity, such as a limited liability company (LLC) or joint-stock company (JSC), as each has different implications for taxes and liability.

- Obtaining an Investment Certificate: This certificate is essential for foreign businesses and is issued by the DPI after evaluating the feasibility of the proposed project.

- Registering with Tax Authorities: Following the approval, businesses must register with the General Department of Taxation to obtain a tax code.

- Opening a Bank Account: Companies are required to have a local bank account for capital transactions, which involves additional documentation.

- Getting Additional Licenses: Depending on the industry, further licenses may be required, such as permits for food services or construction.

Timeline and Costs

The entire registration process can take anywhere from 10 to 30 days, depending on the complexity of the business structure and the preparation of documents. Costs vary, but entrepreneurs should budget for government fees, legal consultations, and other miscellaneous expenses, potentially amounting to several thousand dollars.

2. Investment Structuring & Legal Roadmapping

Strategic advice on the most suitable entry mode, capital requirements, and legal safeguards

3. Market & Regulatory Due Diligence

Sector-specific intelligence, competitor analysis, and regulatory risk assessment

4. Government Liaison & Licensing Support

Efficient handling of local licensing, sector permits, and foreign ownership approvals