Does Your Foreign Loan Need Registration?

The rules for registering a foreign loan with the State Bank of Vietnam (SBV) depend primarily on its term (tenor). Use this interactive checker to get a quick assessment based on your loan's characteristics.

Your result will appear here.

Key Compliance Risks & Consequences

Understanding the high stakes of non-compliance is crucial. Failure to register a required loan isn't just a paperwork issue; it has severe financial and operational impacts.

Financial Penalties

Organisations face significant fines for failing to register a foreign loan, ranging from VND 40 million to VND 60 million.

Frozen Transactions

Banks are prohibited from processing disbursements or repayments for unregistered loans. This effectively freezes the loan, leading to default.

Mandatory Reporting

All foreign loans, registered or not, require mandatory online reporting to the SBV by the 5th of every month.

Registration Triggers: The Role of Loan Tenor

The primary factor determining the need for registration is the loan's term. While long-term loans have a clear rule, short-term loans carry a hidden compliance risk known as the "short-term loan trap."

Medium & Long-Term Loans (> 1 Year)

The rule is unambiguous: any foreign loan with a term exceeding one year must be registered with the State Bank of Vietnam. There are no exceptions to this requirement. Registration must be completed before any funds are disbursed or repaid.

The "Short-Term Loan Trap" (≤ 1 Year)

Generally exempt, a short-term loan becomes registrable if:

- Formal Extension: An agreement is signed to extend the loan, pushing the total term beyond one year.

- De Facto Extension: Any principal remains outstanding on the one-year anniversary of the first drawdown (a 30-working-day grace period applies).

- This means a simple repayment delay can unexpectedly trigger a full registration requirement, a major compliance risk.

Why Loan Purpose is Now a Critical Condition

With Circular 08/2023/TT-NHNN, the SBV shifted from a procedural checker to a substantive gatekeeper. A loan that meets the tenor criteria can now be rejected if its purpose is not permissible. This is a fundamental change in regulatory oversight.

The End of "Holdco Financing"

| Permitted Purpose | Before Circular 08/2023 | After Circular 08/2023 |

|---|---|---|

| Implement Borrower's Own Project/Business Plan | ✅ Permitted | ✅ Permitted |

| Implement the Subsidiary's Project/Business Plan | ✅ Permitted | PROHIBITED |

| Restructure Borrower's Foreign Debt | ✅ Permitted | ✅ Permitted |

| Pay Short-Term Payables | Broadly interpreted | ✅ Permitted (with new restrictions) |

The Impact

Borrowers can no longer obtain a foreign loan to finance the projects of their subsidiaries. This dismantles the common "Holdco" financing structure, forcing capital to be more transparently linked to the entity that will actually use it, either through a direct loan to the subsidiary or a formal equity contribution.

The Requirement

All borrowers must now prepare a detailed "Foreign Loan Usage Plan" or "Debt Restructuring Plan." This plan must be internally approved *before* borrowing and is submitted to the SBV for scrutiny during registration to prove the loan is "valid and reasonable."

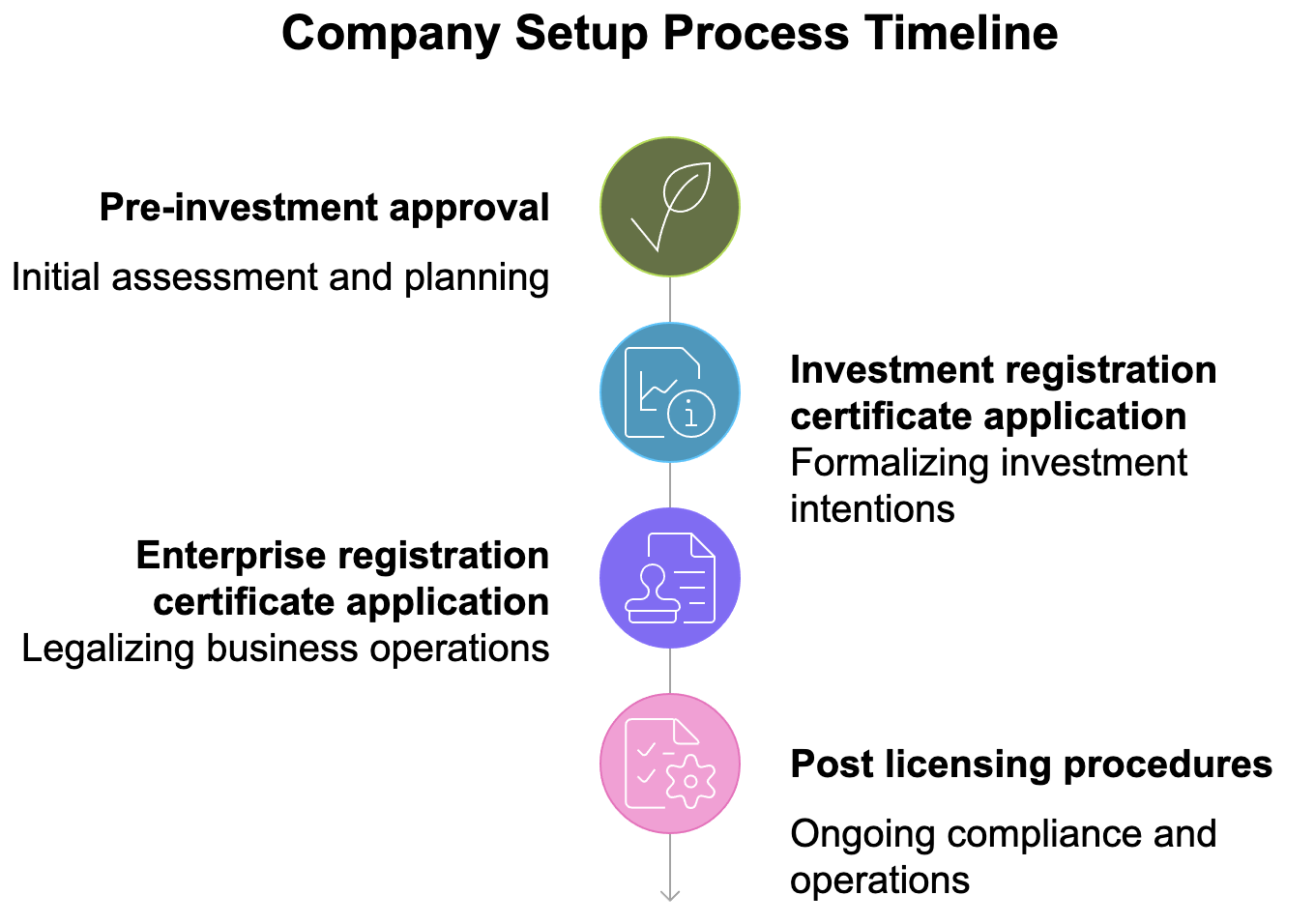

The Registration Process Step-by-Step

The registration process involves both online and physical submission. Following these steps correctly is crucial for a timely approval from the competent SBV authority.

Create Online Account

Register for an account on the SBV's official web portal for managing foreign loans.

Declare Loan Online

Log in to the portal and fill out the detailed loan declaration form online.

Prepare Physical Dossier

Print the online form and gather all supporting documents (loan agreement, usage plan, etc.).

Submit to SBV

Submit the complete physical dossier to the correct SBV authority (Central or Provincial branch, based on loan amount).

Submission Deadlines

Adherence to submission deadlines is critical. The timeframe depends on the event that triggers the registration requirement. The chart below visualizes the key deadlines.

Strategic Recommendations

The evolving regulatory landscape requires a proactive and strategic approach. Both borrowers and lenders must adapt their processes to ensure compliance and mitigate risk.

For Borrowers

- Structure Loans Carefully: Ensure loan purpose clauses align perfectly with Circular 08/2023. Make SBV registration a condition precedent to drawdown.

- Conduct Rigorous Due Diligence: Treat the "Foreign Loan Usage Plan" as a critical internal document that can withstand SBV scrutiny.

- Manage Cash Flow Proactively: For short-term loans, ensure you have a solid plan to repay within one year to avoid triggering registration.

For Lenders

- Expand Due Diligence: Review the borrower's Loan Usage Plan to confirm its compliance, as a non-compliant purpose will prevent disbursement.

- Insist on Conditions Precedent: Make the SBV's written registration confirmation a non-waivable condition before disbursing any funds.

- Monitor Ongoing Compliance: Require borrowers to provide proof of their mandatory monthly reporting to the SBV as part of covenant checks.

Comment